Minimum custom amount to enter is AED 2

By donating, you agree to the Privacy Policy and Terms of Service

Medical insurance may not be a mandatory requirement in Dubai, but it’s definitely a necessity. It’s designed to give residents access to essential healthcare services, and in many cases, it does exactly that. But for many, the path to getting care isn’t always smooth.

Want instant updates? Follow Lovin on WhatsApp, and never miss a beat!

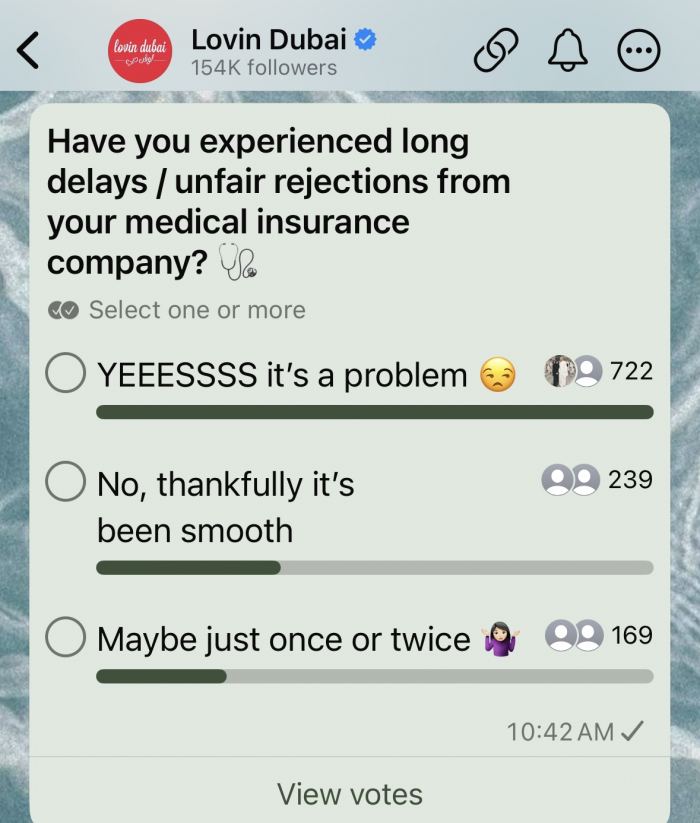

Out of all the participants, 722 said yes, 239 said no, and 169 replied maybe once or twice, indicating that for a significant number of people, getting the green light for basic treatment isn’t as straightforward as it should be.

To understand the issue better, I spoke to several residents about their experiences.

S.I. shared how, despite her doctor recommending physiotherapy, her insurance provider insisted she try medication first, even though she already had. “It took over a week of back-and-forth before they finally approved the sessions,” she said.

L.A. had a similar experience. Her B12 blood test and supplement were rejected, despite her symptoms being directly linked to a deficiency. “It’s frustrating,” she said. “There’s growing awareness of how common vitamin D and B12 deficiencies are in this region, yet tests and treatments for them are often not covered.”

“In one instance, I visited a general physician for persistent knee pain. The doctor recommended an X-ray to determine the underlying issue, but my claim for this basic diagnostic procedure was denied. I was left with no choice but to pay the full cost out of pocket.” The challenges didn’t stop there for M.A. “In another case, while I was unwell, the attending doctor advised a blood test to help diagnose the illness. Once again, the claim approval was unnecessarily delayed and ultimately rejected, leaving me to bear the expense myself.”

These are just a few examples that reflect a broader issue faced by many residents in the UAE. Patients are often denied diagnostic services or reimbursed for only a fraction of the cost, despite holding insurance policies that should cover such treatments.

While insurers often cite the need for proper documentation and policy limitations, for patients, the impact is deeply personal. Delays can mean prolonged pain, worsened conditions, or emotional stress, and for many, it raises the question of whether the system is working with them or against them.

Of course, not all insurance interactions are negative. Many residents do report smooth claims and timely approvals.

C.F. praised the overall quality of care in Dubai, saying, “In comparison with my home country, the insurance here is impeccable. The emergency rooms are quiet, and the service is always smooth. I would choose healthcare here over my home country any day.”

A.A. shared how his insurance plan has worked seamlessly in his favour. “Direct billing, an easy reimbursement process, and access to nearly every hospital, it’s been extremely convenient,” he said. His coverage went beyond just local healthcare.

He also highlighted that mental health support, in the form of therapy, was included in his plan.

Throughout my adult years living in Dubai, I’ve had two different insurance providers — one was completely trouble-free, while the other came with a few hiccups. When I needed physiotherapy, the approval process dragged on, with endless requests for additional information from the doctor. It felt like a waiting game with no clear timeline. Eventually, the treatment was approved, but only after a week of delays. In contrast, my previous insurance handled everything smoothly. They approved consultations, tests, and even costly treatments with minimal delay. I also had direct billing for psychiatry, and my medication was covered with a small co-payment charge (two benefits I no longer have with my current provider).

Medical insurance in the UAE is a vital safety net, and for many, it works exactly as intended, offering peace of mind, financial protection, and access to quality care. From seamless direct billing to international coverage and mental health support, countless residents have had positive experiences that reflect a well-functioning system.

But on the other side, a significant number of policyholders continue to face challenges, from delayed approvals to unclear claim rejections. These frustrations point to a need for greater transparency, consistency, and patient-focused reforms.

Stay in the loop with Dubai’s hottest news, right at your fingertips! Download the Lovin Dubai app for FREE to catch the latest stories on your phone.

Plus, the Lovin Dubai newsletter just got a refresh! Sign up now for your daily dose of news, straight to your inbox!

Get ready to rep your city in style! The Lovin Merch drop is here – Grab yours now!

Minimum custom amount to enter is AED 2

By donating, you agree to the Privacy Policy and Terms of Service